Executive Summary

This is my initial coverage of JLP, a liquidity providing position on Jupiter.

Overview of Jupiter Protocol

JLP is an LP token on Solana that generates yield on a basket of crypto assets including SOL, wBTC, ETH, and stablecoins. The yield comes from onchain trading activity on the Jupiter perpetuals exchange.

Onchain derivatives are a fast growing sector, up over 3x this year in average monthly volume.

This trend reminds me of the growth of onchain spot volume.

Since DeFi summer, DEXs have gone from irrelevant to over 13% of total spot volume. While price discovery still happens on CEXs, onchain activity has created opportunities for retail market makers to collect fees and generate revenue from DEX swaps.

My hypothesis is that the trend in trading volumes moving onchain will continue, and the sector primed for the most growth is perpetual futures.

Jupiter is an app on Solana that has several features including a perpetual futures exchange.

This report will focus on Jupiter’s liquidity providing position, JLP.

JLP acts as a counterparty to Jupiter perp traders, collecting trading fees and maintaining exposure to Jupiter perp traders PnL. On any given day Jupiter typically has the 2nd highest volume of any onchain perp exchange, and maintains the dominant position in this category on Solana.

There are 3 factors which significantly impact price performance of JLP

Fees generated

Trader PnL

Asset price performance (directional exposure to SOL, and to a lesser extent BTC and ETH)

JLP return = JLP fees + trader losses + asset exposure

Notably, trader losses could be profits which would be subtracted from net LP returns. Also, the price of SOL/ETH/BTC could go down which would reduce the dollar denominated value of the pool. However, in practice frequently the price of SOL/ETH/BTC going down causes mass liquidations and losses for traders which mitigate JLP’s volatility during market corrections.

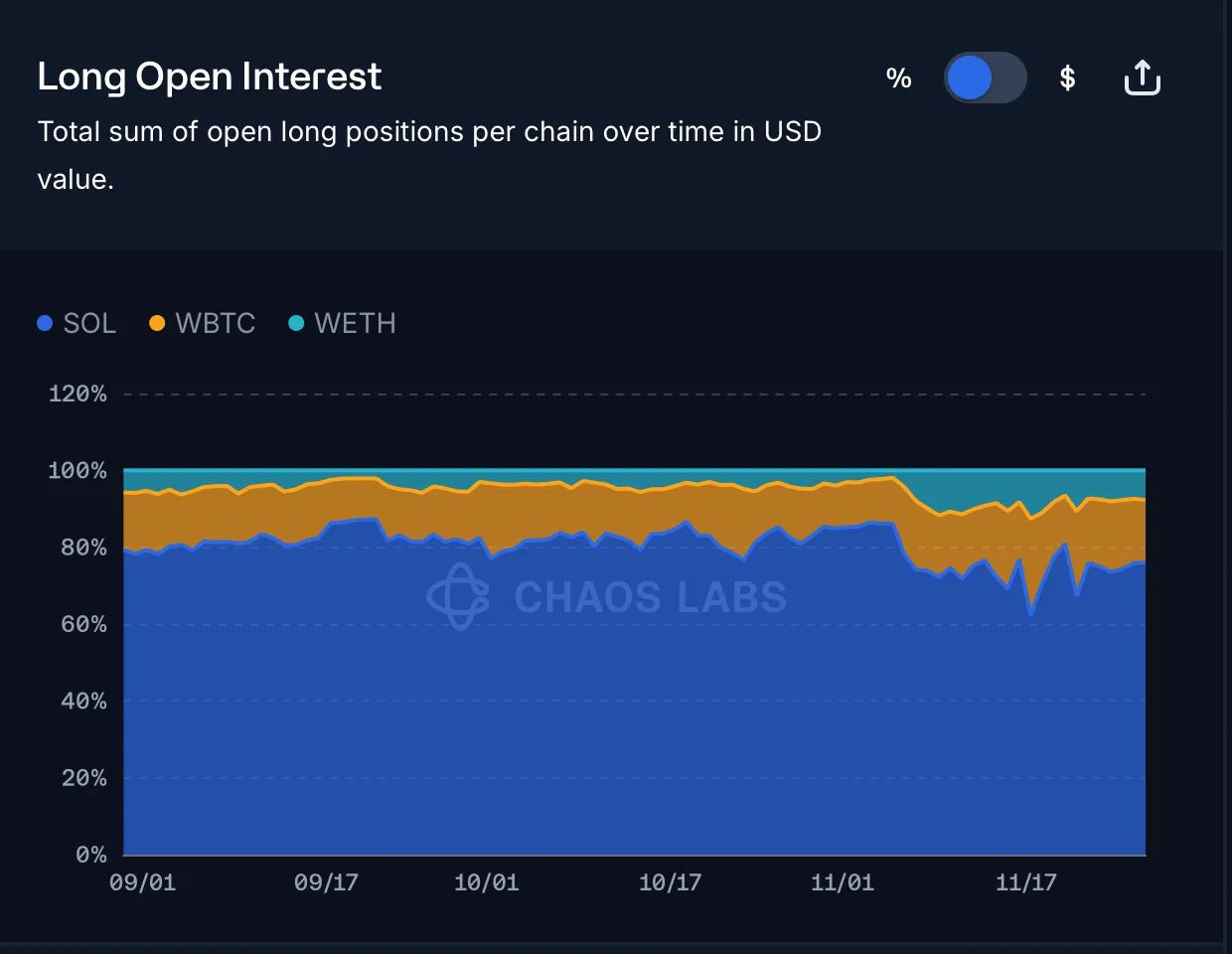

Traders on Jupiter skew disproportionately bullish.

There is no mechanism to balance open interest on Jupiter, so it’s frequently over 95% long. This means that when the market corrects, large swaths of positions on Jupiter are liquidated and realize losses, increasing the antifragility of JLP.

JLP consists of SOL, ETH, wBTC, USDC, and USDT, so it also has spot long exposure. This long exposure means the pool performs well (dollar denominated) when the market is bullish, despite traders realizing profits.

In summary:

In bullish conditions, JLP outperforms stablecoins

In bearish conditions, JLP outperforms SOL/ETH/BTC

In neutral conditions, JLP earns 30%-80% APRs from trading fees and is less impacted by trader PnL

Strategy

My thesis is that as cyclical crypto market optimism continues throughout 2025, I can reduce my downside risk, generate yield, and maintain upside exposure by building a position in JLP.

For example, last week I broke down an out of range SOL/USDC concentrated liquidity position to pay down USDC loans on Kamino and purchase JLP, reducing risk across my portfolio.

Want more real time onchain defi strategies? Join the TG here.

Protocol Overview

Perpetual Exchange

Jupiter is the dominant perpetuals exchange on Solana & is does about 3x the volume of the next largest (Drift).

Jupiter supports leverage trading of BTC, ETH, and SOL up to 100x.

There are 4 types of fees on Jupiter Perps:

A flat 0.06% (6bps) base fee, applied on notional position size when opening & closing the position.

A price impact fee, simulating the orderbook impact given notional size.

Borrow fee, paid hourly on open positions, based on notional size.

Transaction & Priority fee to create trade requests.

75% of these fees are redirected back into the JLP pool, accruing value to the holders of JLP. See more info about the fee structure in the docs here.

Notably, Jupiter does not charge a funding fee to balance open interest.

JLP Token Mechanics and Yield Estimates

A quick look at Jupiter open interest will show you that traders skew tremendously long. While that may not always be the case, it generally has been during the history of JLP so far.

Relative Performance in bullish conditions

Let’s evaluate the performance of JLP over the last 3 months during bullish market conditions where traders have been long and profitable.

Since September 1st, SOL has risen approximately 82.3% resulting in $150M in realized profits for Jupiter traders.

Despite trader profitability during this period, JLP has also risen 33.5% over the same time period.

Price Performance in Bearish/Neutral Market Conditions

Contrast this with different less exuberant market condition, I’ve cherry picked a bearish/neutral recent period in the market, where SOL fell 12.15% and JLP appreciated 7.98%.

SOL is the most relevant asset in the liquidity position because it nearly half of the liquidity pool and typically around 75% of open interest.

Risk Considerations

Trader PnL

One high risk situation for JLP holders is if open interest flips short and then the market pulls back. This would cause traders to realize profits while the underlying value of the assets in JLP simultaneously decrease.

Mitigation: To mitigate risk exposure to trader PnL I will consider setting a trigger of an open interest level of 65% short. If that were to occur, I could cut my JLP position to prevent risk of significant loss in the event markets fall while traders are net short.

Smart Contract Risk

Holding JLP exposes user assets to smart contract risk. You can read more about Jupiter’s security audits here.

Opportunity Cost

JLP is likely to underperform spot SOL in bullish market conditions. However, it’s likely overperformance in neutral and bearish conditions makes it an attractive position to build and take profits into throughout the bull market.

Summary

JLP has the highest return to volatility ratios I’ve seen in crypto, so it makes sense for me to derisk into it as the bull market progresses.

If sometime in 2025 or 2026 the market turns bearish and open interest on Jupiter flips short, I’ll consider exiting into BTC/ETH/SOL/stables.

Additional Resources:

Analytics Dashboards:

https://app.gauntlet.xyz/protocols/jupiter

https://community.chaoslabs.xyz/jupiter/risk/overview

https://flipsidecrypto.xyz/flyingfish/jup-perps-stats-yLSGj_

https://dune.com/ilemi/jupiter-perps

Jupiter Links:

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions from a guy from the internet.

Want more real time onchain defi strategies? Join the TG here.